The impact of technology on employment, economy and society. Interview 1 : Martin Ford

This interview is the first interview of a serie of interviews in french and in english with experts from different fields (philosophy, entrepreneurship, economy, scientists,...) about the impact of technology on employment, economy and society". Il you are interested to participate in this project, you can contact Christophe Petit : petit758@gmail.com.

From C.Petit in Le journal du MAUSS :

http://www.journaldumauss.net/?L-avenement-de-la-societe-de-1217

Hello Martin,

Firstly, thank you very much for this interview as I have been very interested in your work since you have published your first book so the difficulty for me will be to select the questions as I do have hundreds of them. I would like to do a second interview after this one as I think that people from the MAUSS who are mainly academics will have a lot of questions to ask you.

You earned a BSE in computer engineering, magna cum laude, from the University of Michigan and a graduate business degree from UCLA’s Anderson School of Management. You are the founder of a Silicon Valley-based software development firm. In 2009 you published your first book “The lights in the tunnel : Automation, accelerating technology and the economy of the future” so you are a pioneer regarding the analysis of the impact of automation on the economy that has grown in the last few years. In 2015 you wrote a second essay, “Rise of the robots : technology and the threat of a jobless future” which received the 2015 Financial Times and McKinsey Book of the Year Award.

1. Could you describe the process of thoughts that led you to write your first essay ?

I have spent my entire career in computer hardware and software engineering, so I have been very close to the technology and have observed the progress of Moore’s Law at close hand, so that is certainly an important part of the process. Additionally, I started a small software company in Silicon valley in the late 1990s to develop applications for Microsoft Windows. Initially, running this business was quite labor-intensive : software was delivered as a tangible product, including CD-ROMs and printed manuals. All this had to be packaged and delivered to customers, and so there were jobs for workers with limited skills to do all this. However, virtually all this work evaporated within just a few years, and now, of course, software is delivered electronically or hosted in the cloud. A similar process has taken hold with other information that can be digitized (music, e-books, etc.).

As I observed this process in my own small business, it occurred to me that eventually a similar effect would scale across the entire economy as artificial intelligence and robotics gained traction. This led my to write my first book, which was published in 2009

2. One aspect of your work is that you are an economist who uses thought experiments in the tradition of Henry George and this is probably one of the reasons why Einstein admired this economist as he used himself a lot of thought experiments in his work. It is interesting to underline this aspect because in the last decade, the economist thought has been very formal. The title of your first book is based on the thought experiment of the “lights in the tunnel”. Could you explain this thought experiment and describe almost a decade now after you formulated this hypothesis what is your position today regarding this hypothesis ?

In general, as you say, I think thought experiments can be very useful, especially for analyzing the implications of trends. One good technique is to imagine a very extreme condition (such as the automation of most or all jobs in the economy). The point is not to argue that this will actually occur in the foreseeable future, but rather to think about what it would mean for the overall economy and perhaps gain some insight into what we might expect in less extreme and more realistic scenarios.

The thought experiment I used in “The Lights in the Tunnel” was intended to examine the implications of job loss which led to a reduction in the number of viable consumers in the economy. So I imagined a dark tunnel full of star-like points of light. Each light represented a consumer and the brightness of light represented the relative purchasing power (income) of that consumer. So the tunnel was filled with a few very bright (wealthy) lights and a large number of lights clustered around an average income, just as you would find in an actual developed economy.

These consumer lights continuously bounced against the walls of the tunnel, which were lined by businesses I imagined as represented by colorful flat panel displays. Each time a light touched a panel, a transaction took place. So I imagined a cycle in which purchasing power moved from lights to businesses (consumer sales) and then back to the lights (income from jobs). This was the primary drive cycle of the consumer economy.

The point was to show as that jobs disappeared, the lights would begin to fade and the businesses would in turn have to compete for a smaller set of viable consumers. As the lights dimmed, the health of the entire economy would be threatened.

One some level this should be obvious, but the point was to provide a kind of visual simulation to make the effect clear to the reader.

3. You seem to be a moderate liberal but I think that it would not be correct to analyze your work with the classical political grid. It seems that your work belongs to another tradition which genealogy could be traced back to the book “On the inequality among men” by Jean-Jacques Rousseau and which has a cultural branch [1], a functionalist branch [2], a demographic branch [3], an exchange and resources branch [4], a political branch [5], a monetary branch [6], a technical branch [7]. Would you agree to say that your work belongs to a “technical branch” of the analysis of the origins of inequalities ? How would you situate your work in an intellectual map and therefore, what kind of map would you use in order to situate your work ?

Generally, I don’t consider myself very ideological at all. I believe in capitalism and that the market is generally the best way to deliver most products and services. I also believe there is a clear role for government in moderating and regulating the market.

For the most part, I am a pragmatist and approach this as an engineer. My point is to identify a looming problem and suggest a solution. I think even extreme libertarians (or market fundamentalists) would agree that there is at least a minimal role for government in things like protecting property rights and institutions like a court system to resolve conflicts. My argument is that the basic list of government functions may have to expand in the future—perhaps to include something like a basic income—if we want capitalism to continue to be viable (and supported by the public).

4. Do you think that because of the exponential nature of technological progress, technology will become or has already become the main cause of economic inequalities ?

Yes, absolutely. I do not by any means discount other factors, such as globalization or political choices and policies. For example in the U.S. we have nearly eliminated labor unions in the private sector and we have allowed the minimum wage to decline in real terms. Those are definitely important contributors. However, technology has also been very important, especially in the decline in good middle-skill jobs (or job market polarization). The most important point is that this effect will certainly be greater in the future as AI and robotics technologies continue to accelerate. If we eventually achieve something close to true human-level AI, the impact will be profound.

5. The debate regarding the impact of technology on work has been frozen for decades if not centuries. The main reason is the luddite fallacy which is a historical observation that technological progress always creates as much work than if destroys. Although economists insist on the fact that there is no economic law according to which technological progress can create as much work as it destroys, it is understandable that this makes the works regarding the risks of the impact of technological progress on work and on the economy sound naïve and alarmist. Could you explain the reason why this time, the impact of technological progress on work and on the economy could be different ?

The most important difference is that machines are beginning to think and to take on truly cognitive roles. And that will accelerate.

You might make a comparison to horses. There is no “Luddite fallacy” for horses ! Horses permanently lost their jobs when cars, trucks and tractors came along.

Economists would, of course, be quick to point out that people are intelligence and can learn to do new things—to adapt. Horses cannot. However, the machines that will threaten human workers in the future are nothing like the trucks and cars that displaced horses. We now have machines and algorithms that can learn and adapt—and so these technologies are beginning to encroach on the fundamental quality that sets humans apart from horses.

6. The economists McAfee and Brynjolfsson have insisted recently on the great decoupling between the median income and the real GDP. I do think that this great decoupling is a consequence of the exponential nature of technological progress and the monetary policies which concentrate money at the top of the economic pyramid. Do you agree with this analysis or do you have another analysis ?

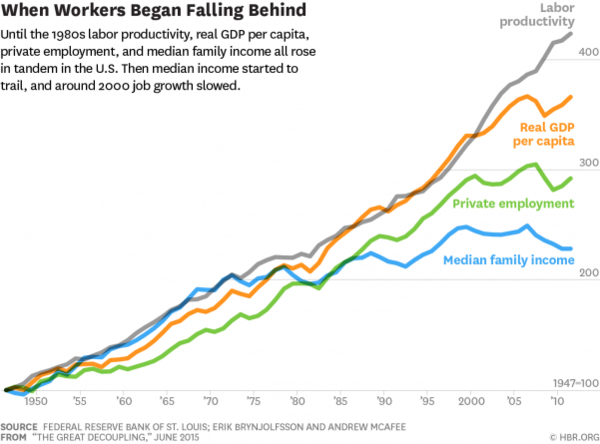

Yes, there are several decouplings—all of which can to some degree be attributed to technology :

Average incomes have decoupled from median incomes, or in other word, inequality has increased.

Productivity had decoupled from employment, so that increases in productivity no longer result in job growth as was once the case. (this is what McAfee and Brynjolfsson refer to).

In my latest book, I have a chart showing that productivity has decoupled from the wages of average workers. In other words, most average people are no longer getting a share of innovation and progress.

7. I think that there is a real issue with the way the problem of the impact of automation on work and the economy is expressed. I think that it has to do with the fact that work has become a value in itself, whatever is the nature of the work. Recently Graeber wrote about the bullshit jobs [8] which are the jobs that the people who do these jobs find useless for the society. In a recent study led by the British government, 37% of the workers did say that they found that their jobs were useless [9]. On the other hand, there is the famous productivity paradox of Solow which states that we do not see the effect of computers on economic productivity [10]. Do you think that the explanation of the productivity paradox could be the development of a rent-seeking economy described recently by Hudson (or Stiglitz, Schiller,…) that is taking the productivity gains brought by automation ?

I think there are various explanations for the productivity paradox and rent seeking may be an important part of it. Although it should be noted that we did see a burst of productivity in the late 1990s and early 2000s, so perhaps one explanation is that the increases come in spurts and we will so see the next installment.

Many economists have suggested there are measurement problems, particularly in that many important recent innovations are provided without direct charge to the consumer (Google Maps, Facebook, etc).

I think it is also important to consider the impact of inequality on demand. I believe that productivity is limited by demand. If most consumers have less to spend, then production may be below potential. In this case, productivity may also be below potential unless all businesses are very draconian and run with minimal work forces. So if demand is slack and there is an “ouput gap” in the economy, measured productivity it to a certain extent a composite of arbitrary management decisions across countless individual businesses. So if technology increases un (or under) employment or drives down wages, it can reduce demand and therefore productivity.

8. As your work concludes that automation will lead to a rise of inequalities and a decrease of work, you suggest a basic income. The main issue with the basic income is that it is very difficult to finance such an income. I do think that, given the way the monetary system works, the money being created in the banks (mostly in commercial banks), the money will always remain at the top of the economic pyramid because of the lobbying of these banks and the tax heavens and speculative loops that keep the money at the top of the economic pyramids. Therefore the governments will never have enough money to finance a basic income as the money created and therefore distributed in the economic system is immune from tax and therefore immune to redistribution of wealth. Do you think a basic income based on redistribution of wealth is possible in such a monetary system or not ?

There is no way around the fact that a basic income will be a huge challenge socially, politically and fiscally. I suspect we will implementt it when the cost of not doing is even greater than the cost of doing it.

I think the problem you describe is actually an argument for a basic income. The problem with our current monetary system is that in the absence of good jobs there is no mechanism to get sufficient income into the hands of consumers. So the central bank can increase the money supply, but as you stay it says at the top, or sloshes around in the banking system without getting into the real economy. This is the “liquidity trap” problem.

So one solution is to give money directly to consumers. You might actually do this – at least initially on a temporary basis—by actually printing money to partially fund the basic income. In other words, true helicopter money. As consumers then spent this money, you ought to see economic activity increase, and then there would be more to tax—so perhaps that would be a way to initiate a sustainable cycle.

9. There is today a populist wave in the United States and in Europe. Do you think that the main cause of this populist wave is the increasing economic inequalities and the technological progress that lead to these inequalities ?

Yes, certainly. The primary cause is inequality and especially the lack of good middle class jobs that are accessible to most of the population. Good factory jobs have been replaced by low wage service sector jobs. Technology is the most important (but not only) cause of this.

10. The historian Braudel in his study of capitalism showed that the economic center of the world has always moved to the west, from Athens to Roma, Amsterdam, Paris, London and New York. Do you think that California with Silicon Valley and Hollywood has become the new center of the world economy or do you think that New York with Wall Street is still the center of the world economy today ?

Silicon Valley is certainly having more influence and it appears that the major companies here (Google, FaceBook, etc) are going to remain dominant in artificial intelligence, so that will certainly increase the influence and power of this region. On the other hand, the general trend is to increase the value and importance of capital, so that will also increase the power of the financial industry. So I would say that Silicon Valley will share the stage but will not displace the traditional power centers.

11. We are living since the last financial crisis in a state of perpetual quantitative easing. Do you think that these monetary policies are the results of a systemic declining demand described by the historian Wallerstein [11] and do you think that this declining demand is caused by automation ?

Yes, I think tepid demand is certainly part of the problem. Economists talk about “secular stagnation” or an environment where there are two few attractive investment opportunities, so investors tend to want to sit on cash. We see this will large U.S. companies like Apple sitting on huge quantities of cash. I think that the automation of well-paying middle class jobs (polarization) as well as inequality in general are certainly contributing to this situation. As the trend continues I think it will likely be very difficult for central banks to break out of the current scenario.

12. The sociologist Ellul once said the the problem is not the technics in itself but the sacralization of technics by men. As you do live in Silicon Valley, do you think that transhumanism with the singularity is becoming the mainstream progressive ideology ?

I wouldn’t say it is yet mainstream, although there is certainly much more awareness of the ideas outside the technology elite. I think progressive ideology is still much more focused on identity politics and social justice, as well as climate change. The singularity and transhumanism are still pretty fringe, I would say.

13. What can we learn from the past in order to have a smooth transition to this technological evolution ?

I think we can learn from our success in recovering from other disruptions like the Great Depression and the extreme inequality of the 1920s. However, it would be a mistake to assume that the solutions will be the same this time around. Historically, the most effective solution to extreme equality has been a major war – so hopefully we can come up with a better solution this time around.

14. What will be the line between automated jobs and not-automated jobs and how will this automation process affect white-collar and blue-collar jobs ?

Well, the line is really defined by the nature of the job. Is it a job that is on some level fundamentally routine and predictable ? If the answer is yes, then the job may soon be automated, regardless whether it is a blue-collar, manipulative task (requiring a robot) or a white collar, knowledge based task (requiring only software).

The key thing to understand, however, is that this line between what can and cannot be automated is highly dynamic. It is shifting all the time to include more jobs and tasks. Maybe the best recent example of this was Google’s AlphaGo system that was able to defeat the best Go player in the world – this is a game far more complex than chess, and would probably be characterized as “safe” job, yet the computer was able to prevail.

15. What kind of skills will be the most immune to this automation wave ?

For the foreseeable future, I would say genuine creativity and also deep interactions and relationships with other people. However, both these areas are subject to ongoing research. For example, there are already systems that create art or write symphonies. So there is no guarantee that this areas are safe forever. But for now, many areas of health care, such as nursing for example, are probably quite safe from automation.

16. How have your thoughts evolved since you are working on the impact of automation on the economy ?

Mostly I have been surprised by the rapid pace of innovations. I did not expect self-driving cars for example to show so much progress and create so much competition by this stage. Also, I have been surprised by advances in areas like deep learning. So I would say things are moving at least as fast as I had expected, maybe more so.

17. The interview will be published in the revue of MAUSS which is an acronym for anti-utilitarism movement of social sciences inspired by the sociologist Mauss and his social paradigm of the gift. The MAUSS revue is also inspired by the work of Polanyi who showed that in non-market societies, economic activities are embedded in non-economic kinship. Do you think that automation could lead to a non-market society thanks to a universal income ? To be more precise, it would obviously not be the end of the market but the market and its values such as growth would be embedded in others values (ecology, equality, creativity, care, art and science…) ?

I continue to be a strong believer in the market economy. However, I think it needs to be adapted to the reality of the future. Part of this adaptation will be moderating some of the incentives built in the market and providing everyone one, for example, with a basic income. This would allow many individuals to devote most of their time to primarily non-market activities (art, working in the community, etc.), but would still preserve the primary market incentives that cause businesses and innovators to make us collectively more wealthy over time.

18. Programmers do not only program software, they also program our own minds who use software. I like your books because they introduce thought experiments (as physician theorists do) in an era dominated by analytical thinking. Do you think that we are being more automated than the machines themselves and that our critical thinking is collapsing to a form of analytical thinking without imagination ?

I do worry about the impact of advanced digital technology on creative thinking, especially among children and young people. When I was child for example, there were only books or television with a very few choices. So as children we used our imagination all the time. Now, there is constant availability of realistic video games, etc. So there is much less need to be creative. For this reason, I try my best to restrict my own children from spending too much time with devices.

19. The paradox of our society seems to be that technology is providing us with possibilities to focus more on art and science and less on work but the ideology of work seems to be stronger than ever and the incentive to work is also greater because of the rising inequalities (therefore the incentive to go from the top 50% to the top 20% through work is greater than 50 years ago. Do you think that the recent books about the topic of automation have changed the way people think about work ?

Not yet. I think the work ethic is very strongly embedded in our values and there is still a very strong tendency to attach stigma to those who cannot find work. As automation progresses, I think this will have to change and we will have to accept a society where people work less, and perhaps some people do not work at all. This will require a major shift in our values.

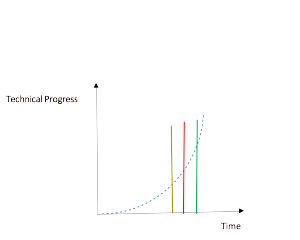

20. The following graph is similar to the last graph as it just shows the results of the exponential progress of technologies. The blue exponential line shows the progress. The green line shows the purchasing power of a rich individual in the USA today and the red line shows, the purchasing power of a poor individual in the USA today and the yellow line shows the purchasing power of the richest individual in the world in XVth. century. The usual ideology of progress that we can find all across the political spectrum says that technological progress benefits to all people because the poor person today is richer than the richest person in the XVth century or maybe even of the XIXth century if we measure wealth with access to health, information, energy, transportation,… But the most important aspect in the tradition of the study of inequalities among men from Rousseau to Testart [12] is what has been analyzed recently by the philosopher Belhaj Kacem as the pleonectic. The following curves show explicitly the pleonectic because the gap between the poor person and the rich person always increases with time as technological progress accelerates. We could even imagine that this could lead in the following centuries or even decades with biotechnologies to the creation of new human species with higher intelligence, memory, health that could dominate the others classes of society. Therefore the meritocratic narrative that sustains our society does not seem to resist to the impact of the exponential technological growth and the necessity of an exponential redistribution of wealth that could compensate the exponential growth of technology. So do you think that if we do not change radically our policies (and that does not have to be communist or anarchist new policies), the exponential growth of technology will lead to exponential inequalities and therefore to violence in all its forms ? Do you think that phenomena such as the rise in extremist ideologies, mental healths issues among the youngest people and mass shooting are already the symptoms of this process ?

Yes, I agree with your analysis. I think exponential technology will inevitably result in greater inequality. The immediate problem is that the vast majority of people in the world has a single asset : the value of their labor. As technology erodes this value, they will be left with little or nothing. The ownership of financial and technological capital is, of course, highly concentrated. A recent reports shows that 8 billionaires currently have wealth equal to the bottom half of the global population.

Obviously, all this will lead to political disruptions, instability and quite possibly violence and civil unrest. The solution must be some form of direct redistribution of income (and security) to the bottom of the income distribution. I think the best way to do this is some type of basic income (or citizen’s dividend).

21. I would like to end this interview (or the first part of this interview if you are available for a second part) with a thought experiment in the tradition of George that you are following. Let’s consider two islands of one thousand people. There is a wave of automation in these two islands but the monetary policies are different on these two islands. The first island is a top-down monetary policy island in which one million dollars per month is created each month at the top of the economic pyramid. The second island is a bottom-up monetary policy island in which one million dollars is created each month at the bottom of the economic pyramid, therefore each individual receives one thousand dollars each month. Do you think that the gains of automation will lead to a neo-feudal speculative society (and therefore an oligarchy) in the first island and to an economy oriented towards the “real economy”(and democracy) in the second island because the individuals will be encouraged to make money by providing goods and services for the people who receive the money created and not to the organization (public or private bank) that receive the created money ?

Yes, I would generally agree that distributing the money directly to the people at the bottom of the pyramid may be the only way to preserve our current conception of the market economy.

In general, I think that within capitalism there is an inherent drive toward inequality and that wealth will tend naturally to accumulate at the top. This is one of the most important findings of the work by Piketty. So, generally, I believe even in the absence of extreme automation, a “trickle down” approach is likely to be less effective than a “bubble up” approach. If you begin by distributing money to those at the top, it is very likely to stay there, and this will be even more true as jobs are automated. Historically the primary mechanism that has distributed income from the top to the bottom has been jobs. During periods when there are lots of well-paying middle class jobs, then inequality is lower. As these jobs disappear due to automation the distribution mechanism breaks down and inequality is higher. Automation is certain to make this problem more extreme, and therefore a bottom-up approach will be even more important.